Starting a business means making a lot of smart, strategic choices—especially when it comes to spending. Office furniture might seem like a simple, practical purchase, but it plays a bigger role than just filling up your workspace. For many startups, these pieces are more than functional; they are assets that contribute to the company’s overall value. Understanding how office furniture fits into your financial planning can help you make better budgeting decisions, manage depreciation, and even improve your startup’s balance sheet.

Key Takeaways:

- Office furniture is usually a capital asset, meaning it’s depreciated over time and added to your balance sheet.

- Tax rules like Section 179 and bonus depreciation let you deduct furniture costs in smart, flexible ways.

- Invest wisely—buy quality but avoid overspending, using options like leasing or refurbished pieces to stay budget-friendly.

In this article, we’ll break down what qualifies office furniture as an asset, how it’s typically accounted for, and why recognizing it properly can benefit your startup from both an operational and financial perspective.

Is Office Furniture an Asset or an Expense?

Yes, office furniture is a capital asset, not just an expense for most startups. That means instead of writing off the full cost in the year you buy it, you typically depreciate the value over time—usually across 5 to 7 years. This is because furniture often meets the criteria for a fixed asset: it costs more than $2,500 (your company’s capitalization threshold) and has a useful life of more than a year.

As Moattar Ali, VP Marketing for HARO Links Builder startup, emphasizes,

“Office furniture is a depreciable asset strategically used by innovative startups. Quality furniture holds 30-40% of the initial purchase value after three years, whereas low-cost furniture returns 10-15%. Startups can take Section 179 deductions on furniture acquisition. The trick lies in choosing those items that hold their resale value and contribute to employee productivity measures.”

Why Your Startup Should Invest in Quality Office Furniture

The decision to invest in quality office furniture goes beyond mere aesthetics; it directly impacts your startup’s productivity, employee well-being, and bottom line. A study from the Washington State Department of Labor and Industries estimated a $3 to $6 return in cost savings and productivity gains for every dollar invested in ergonomic improvements. This ROI stems from reduced absenteeism, fewer workplace injuries, and enhanced focus—critical factors for startups where every team member’s contribution is vital.

Beyond productivity, well-designed workspaces influence talent retention and company culture. Employees in ergonomic environments report higher job satisfaction and lower fatigue.

As Nikita Sherbina, Co-Founder of tech startup AI Screen, aptly puts it:

“Office Furniture as a Startup Asset: Absolutely—quality furniture reduces turnover-related costs, supports team wellness, and holds residual value. We categorize it as a long-term asset in our books and treat chairs, sit-stand desks, and collaborative furnitures as investments in retention and performance.”

Upgrade your workspace with an ergonomic office chair—a smart investment in both comfort and productivity that turns your office furniture into a true business asset.

Cost-Effective Office Furniture Strategies

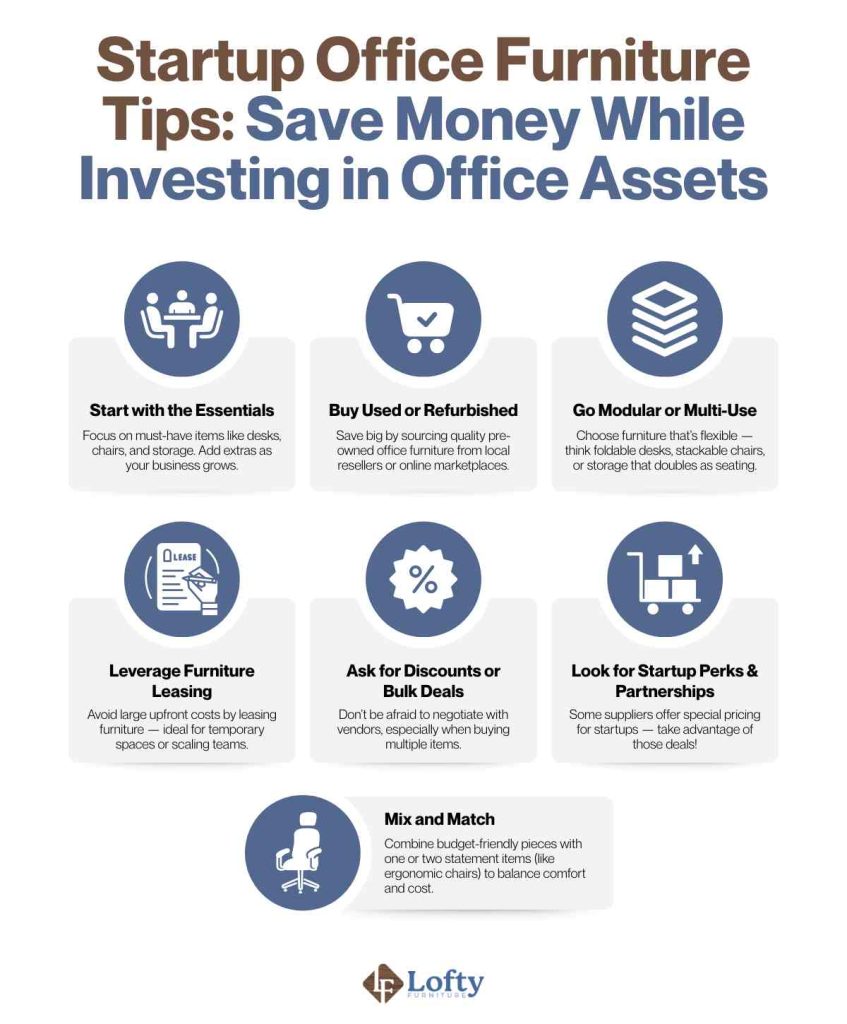

For cash-conscious startups, furnishing an office doesn’t require compromising on quality or employee comfort. One effective approach is buying second hand—nearly new office furniture from liquidated businesses or refurbished suppliers often comes at 40-60% below retail prices. Online marketplaces and specialized office resellers offer high-quality desks, chairs, and storage units that meet ergonomic standards without the premium price tag.

Another flexible option is short-term leasing, particularly useful for startups testing office spaces or anticipating rapid growth. For essential items, focus spending on key ergonomic pieces (like task chairs) while economizing on secondary furniture. Modular designs that you can reconfigure as team expands offer long-term value, ensuring your initial investment adapts to changing needs without requiring complete overhauls.

Potential Downsides of Overinvesting in Office Furniture

While quality furniture offers clear benefits, startups must be wary of overcommitting resources to office setups that may not align with their evolving needs. One significant risk is cash flow strain. Allocating too much capital to furniture purchases can leave insufficient funds for critical areas like product development or marketing. This is particularly dangerous for early-stage startups where financial flexibility is essential.

Another consideration is the rapid depreciation of office furniture. Unlike technology or intellectual property that may appreciate, most furniture loses 20-40% of its value within the first year. This becomes problematic if your startup needs to pivot to remote work or downsize physical space.

Final Considerations: Making Smart Furniture Decisions for Your Startup

The question of whether office furniture qualifies as an asset ultimately depends on your startup’s specific circumstances and growth strategy. Remember that financial decisions about office furnishings should align with your broader business objectives. Whether you choose to buy, lease, or implement a hybrid solution, the goal is to create a functional workspace that supports your team without compromising your startup’s financial health.

Frequently Asked Questions

What is the asset life of office furniture?

The IRS classifies office furniture as a tangible business asset with a depreciation period of seven years, according to IRS Publication 946.

What type of account is office furniture?

Office furniture is classified as a fixed asset in accounting. This means it is a tangible, long-term asset expected to be used in the business for more than one year.

Can office furniture be written off as a business expense?

Yes, office furniture can typically be written off, either through immediate expense (for items under $2,500 via the de minimis safe harbor rule) or through depreciation over several years. The IRS Section 179 deduction also allows businesses to deduct the full cost of qualifying furniture in the purchase year, up to certain limits.

Should a remote-first startup still invest in office furniture?

Even remote-first startups may benefit from limited office furniture investments, particularly for shared workspaces or to support hybrid work arrangements. However, the focus should be on flexible, multi-purpose pieces rather than extensive office setups.

Great insights on office furniture trends! I really appreciate how well you’ve explained the importance of comfort and productivity in workplace design. At PodVare, we also focus on delivering modern and ergonomic office furniture solutions that enhance both style and efficiency in offices. Keep sharing such valuable content